Bitcoin – How it works

It may be debatable how precisely to classify Bitcoin. Is it money, an esteemed store, a payment network, or a resource class?

Fortunately, defining what Bitcoin truly is is less difficult. It’s a scheme. Don’t be fooled by stock photos of gleaming coins adorned with altered Thai baht graphics. Bitcoin may be a totally digital marvel, a set of rules and procedures.

It is also the most successful of hundreds of attempts to create virtual currency using cryptography, the science of creating and breaking codes. Bitcoin has inspired hundreds of imitators, but it remains the largest cryptocurrency by market capitalisation, a position it has held for the past decade.

Blockchain Technology

Bitcoin is a network that operates on a protocol known as the blockchain. To begin with, a 2008 paper by a man or people calling themselves Satoshi Nakamoto depicted both the blockchain and Bitcoin and the two terms were almost synonymous.

Since then, the blockchain has evolved into a contained notion, with thousands of blockchains created using similar encryption algorithms. Because of this history, the language might be perplexing. In a few circumstances, blockchain refers to the primary, Bitcoin blockchain. At times, it refers to general blockchain advancement or to any other blockchain, such as the one that runs Ethereum.

The mechanics and bolts of blockchain innovation are mercifully straightforward. A blockchain is made up of a single chain of distinct pieces of data that are ordered chronologically. As a general rule, this data can be any string of 1s and 0s, which could include emails, contracts, arrival titles, marriage certificates, or bond swaps. In theory, any type of contract between two parties can be established on a blockchain if both parties agree on the contract.

This eliminates the need for a third party to be involved in any deal. This opens up a variety of potential results, including peer-to-peer budgeting goods such as credits or decentralised investment funds and checking accounts, where banks or any middleman are irrelevant.

While Bitcoin’s current goal is to be a store of wealth as well as a payment system, there’s nothing to suggest it won’t be used in such a fashion in the future, though consensus would arise to integrate these frameworks into Bitcoin. The primary goal of the Ethereum journey is to create a platform where these “smart contracts” can take place, so creating a full domain of decentralised budgeting items without any agents and the costs and any data breaches that come with them.

This adaptability has piqued the interest of governments and corporate organisations; without a doubt, some analysts believe that blockchain innovation will eventually be the most influential aspect of the bitcoin boom.

However, in the case of Bitcoin, the data on the blockchain is generally swapped.

Anything can connect to and use the Bitcoin network, and your ethnicity, gender, religion, species, or political beliefs are irrelevant. This has enormous implications for the internet of things. We may see setups in the future where self-driving taxis or uber vehicles use blockchain wallets.

The vehicle would receive bitcoin from the passenger and would not move until reserves were obtained. The vehicle would be able to detect when it is running low on fuel and would use its wallet to promote a refill.

A blockchain is also known as a “distributed ledger,” which underlines the main difference between this breakthrough and a well-kept Word document. The blockchain of Bitcoin is scattered, which means it is open. Anyone can download it in its entirety or visit any number of sites that parse it.

This suggests that the record is open to the public, but it also implies that complicated processes are in place to upgrade the blockchain record. Because there is no central specialist to keep track of all bitcoin exchanges, members do so by creating and confirming “squares” of trading information.

On January 20, 2021, between 11:10 and 11:20 a.m., 15N3yGu3UFHeyUNdzQ5sS3aRFRzu5Ae7EZ transferred 0.01718427 bitcoin to 1JHG2qjdk5Khiq7X5xQrr1wfigepJEK3t. The long strings of numbers and letters are addresses, and if you were in law enforcement or extremely well-informed, you could probably figure out who controlled them. It is possible that the organisation of Bitcoin is wholly hidden, while certain security measures can make connecting persons to transactions extremely difficult.

Post-Trust

Despite being open, or rather because of it, Bitcoin is extremely difficult to exchange. Because a bitcoin has no physical proximity, it cannot be secured by keeping it in a safe or burying it in the woods.

In theory, all a cheat would have to do to get it from you is add a line to the record that says “you paid me everything you have.”

A related concern is dual investing. If a bad actor spent a few bitcoins, then spent them again, confidence in the currency’s value would quickly erode. To achieve a double-spend, the bad actor would need to control 51% of Bitcoin mining. The more popular Bitcoin becomes, the less feasible this becomes, as the computing power required would be gigantic and prohibitively expensive.

Belief is required to progress or prevent either from occurring. In this scenario, the normal money arrangement would be executed through a central, neutral arbiter, such as a bank. The bitcoin organisation is decentralised, rather than having a solid specialist keep the record and direct the arrangement. Everybody keeps an eye on everybody else.

For the framework to function properly, no one should know or believe anyone. Cryptographic conventions ensure that each square of exchanges is blasted onto the final in a long, straightforward, and unchangeable chain if everything goes as planned.

Mining

Mining is the process of maintaining this frictionless open record. A network of miners who record these exchanges on the blockchain could be underpinning the network of Bitcoin customers that exchange the cryptocurrency among themselves.

Recording a series of exchanges is trivial for a modern computer, but mining is difficult because Bitcoin’s software makes the process appear to be time-consuming. Without the added burden, people appear to spoof transactions in order to better themselves or bankrupt others. They appear to log a bogus transaction within the blockchain and pile so many trivial transactions on top of it that unravelling the extortion would have been difficult.

Similarly, it would be trivial to insert fraudulent exchanges into previous pieces. The organization would end up a sprawling, spammy mess of competing records, and bitcoin would be worthless.

Satoshi’s breakthrough was combining “proof of work” with other encryption processes. Bitcoin’s computer programme modifies the difficulties that miners have in order to limit the organisation to one unused 1-megabyte piece of exchanges every 10 minutes. In that manner, the amount of transactions is manageable.

The arranger has time to vet the new piece and the record that precedes it, and everyone can agree on the status quo. Mineworkers do not work to confirm exchanges by adding squares to the distributed record simply because they want the Bitcoin organisation to run smoothly; they are compensated for their efforts as well. We’ll take a closer look at mining remuneration underneath

Halving

As already specified, diggers are compensated with Bitcoin for confirming pieces of exchanges. This reward is cut in half every 210,000 pieces mined, or roughly every four years. This is known as the division or “halvening.” The framework is built-in as a deflationary one, where the rate at which modern Bitcoin is discharged into circulation.

This plan is designed to ensure that Bitcoin mining rewards continue until roughly 2140. Once every Bitcoin has been mined from the code and all halvings have been completed, the mineworkers will be incentivized by the fees they will charge to organise clients. The expectation is that strong competition will keep costs low.

This system raises Bitcoin’s stock-to-flow ratio while decreasing its swelling until it reaches zero. Following the third division on May 11th, 2020, the remuneration for each piece mined is now 6.25 Bitcoins.

Hashes

This may be a more sophisticated picture of how mining works. The network of mineworkers, who are dispersed around the world and are not connected by personal or professional ties, receives the most recent group of exchange information.

They run the information through a cryptographic calculation that creates a “hash,” a string of numbers and letters that confirms the information’s legitimacy but does not uncover the data itself.

You can’t tell what transactions are in the relevant chunk (#480504) based on the hash 000000000000000000c2c4d562265f272bd55d64f1a7c22ffeb66e15e826ca30. In any event, you’ll take a bunch of data indicating that it’s piece #480504 and ensure that it hasn’t been tampered with. If one number was incorrect, regardless of how minor, the information would generate a completely different hash.

If you ran the Declaration of Independence through a hash calculator, you might receive 839f561caa4b466c84e2b4809afe116c76a465ce5da68c3370f5c36bd3f67350. If you remove the period after “submitted to an ingenuous world,” you get 800790e4fd445ca4c5e3092f9884cdcd4cf536f735ca958b93f60f82f23f97c4. Although you’ve changed one character in the original text, this is a completely unique hash.

The hash advancement allows the Bitcoin network to check the authenticity of a block in real time. It would be inconceivably time-consuming to trawl through the entire record to prove beyond any doubt that the individual mining the most prominent afterwards set of deals hasn’t attempted anything significant. Instep, the past block’s hash appears up interior the unused piece. If the first minor detail in the previous section was changed, the hash would change. In fact, if the altar were 20,000 squares back inside the chain, the hash of that block would trigger off a cascade of additional hashes, alerting the network.

But making a hash isn’t actually work. The method is so fast and simple that terrible on-screen characters may still spam the organizer and maybe, given enough computing power, pass off fraudulent transactions several pieces back within the chain. So, the Bitcoin convention requires confirmation of work.

It does so by tossing mineworkers a curveball: Their hash must be underneath a certain target. That’s why piece #480504’s hash begins with a long string of zeros. It’s tiny. Since each string of information will produce one and as it were one hash, the journey for an adequately little one includes including nonces (“numbers utilized once”) to the conclusion of the information. So, a miner will run.

On the off chance that the hash is as well huge, she will attempt once more. Still as well enormous. At last, 93452 yields her a hash starting with the essential number of zeroes.

The mined block will be broadcast to the organization to get affirmations, which take another hour or so, although sometimes much longer, to handle. (Once more, this portrayal is streamlined. Squares are not hashed in their aggregate but broken up into more proficient structures called Merkle trees.)

Depending on the kind of activity the arrange is getting, Bitcoin’s convention will require a longer or shorter string of zeros, altering the trouble to hit a rate of one unused piece each 10 minutes. As of October 2019, the current trouble is around 6.379 trillion, up from 1 in 2009. As this proposes, it has ended up altogether more troublesome to mine Bitcoin since the cryptocurrency propelled a decade ago.

Mining is seriously, requiring enormous, costly rigs and a part of power to control them. And it’s competitive. There’s no telling what nonce will work, so the objective is to plow through them as rapidly as possible.

Early on, miners recognized that they might advance their chances of triumph by combining into mining pools, sharing computing control and divvying the rewards up among themselves. Without a doubt, when various miners portion these rewards, there’s still adequate spurring constraint to look for after them. Each time a new square is mined, the viable digger gets a bunch of as of late made bitcoin. At to start with, it was 50, but at that point it parted to 25, and directly it is 12.5 (around $119,000 in October 2019).

The compensation will proceed to split each 210,000 blocks, or around each four years, until it hits zero. At that point, all 21 million bitcoins will have been mined, and mineworkers will depend exclusively on expenses to preserve the network. When Bitcoin was propelled, it was arranged that the whole supply of the cryptocurrency would be 21 million tokens.

The truth that mineworkers have organized themselves into pools stresses a few. If a pool surpasses 50% of the network’s mining control, its individuals seem likely to spend coins, switch the exchanges, and spend them once more. They seem to block others’ transactions. Basically put, this pool of miners would have the control to overpower the disseminated nature of the framework, confirming false exchanges by ethicalness of the larger part control it would hold.

That seems to spell the conclusion of Bitcoin, but indeed a so-called 51% assault would likely not empower the terrible performing artists to turn around ancient exchanges, since the verification of work necessity makes that preparation so labour-intensive.

To go back and modify the blockchain, a pool would control such a huge lion’s share of the organization that it would likely be inconsequential. After you control the full money, who is there to exchange it with?

A 51% assault could be a monetarily self-destructive recommendation from the miners’ perspective. When Ghash.io, a mining pool, came to 51% of the network’s computing control in 2014, it deliberately guaranteed to not surpass 39.99% of the Bitcoin hash rate to preserve certainty within the cryptocurrency’s esteem. Other performing artists, such as governments, might discover the thought of such an assault curiously, although. But, once more, the sheer estimate of Bitcoin’s arrangement would make this overwhelmingly costly, indeed for world power.

Another source of concern related to miners is the common-sense propensity to concentrate in parts of the world where power is cheap, such as China, or, taking after a Chinese crackdown in early 2018, Quebec.

Bitcoin Transactions

For most people taking an interest within the Bitcoin network, the ins, and outs of the blockchain, hash rates and mining are not especially important. Exterior of the mining community, Bitcoin proprietors ordinarily buy their cryptocurrency supply through a Bitcoin trade. These are online stages that encourage exchanges of Bitcoin and, frequently, other digital currencies.

Bitcoin trades such as Coinbase bring together market members from around the world to purchase and offer cryptocurrencies. These trades have been both progressively well known (as Bitcoin’s ubiquity itself has developed in later a long time) and full of administrative, lawful and security challenges.

With governments around the world seeing cryptocurrencies in different ways – as money, as a resource course, or any number of other classifications – the controls overseeing the buying and offering of bitcoins are complex and always moving. Maybe indeed more vital for Bitcoin trade members than the danger of changing administrative oversight, in any case, is that of burglary and other criminal action.

Whereas the Bitcoin arrangement itself has to a great extent been secure all through its history, person trades are not fundamentally the same. Numerous robberies have focused on high-profile cryptocurrency trades, oftentimes coming about within the misfortune of millions of dollars worth of tokens.

The foremost popular trade robbery is likely Mt. Gox, which ruled the Bitcoin exchange space up through 2014. Early in that year, the stage reported the plausible robbery of generally 850,000 BTC worth near to $450 million at the time.

Mt. Gox recorded for liquidation and covered its entryways; to this day, most of that stolen bounty (which would presently be worth an add up to of approximately $8 billion) has not been recuperated.

Keys and Wallets

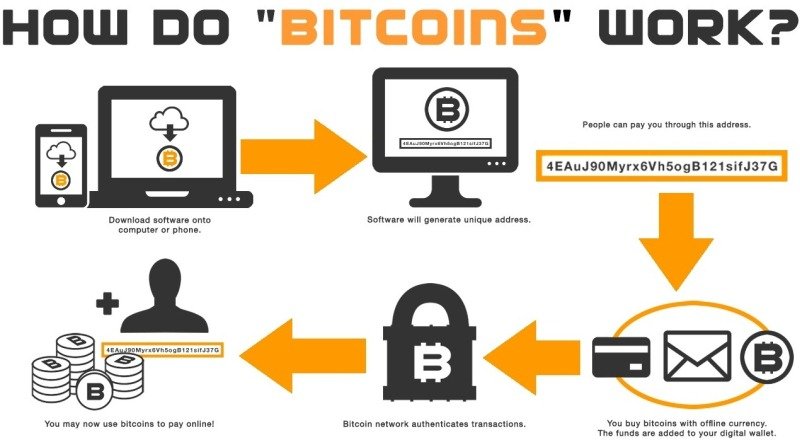

For these reasons, it’s justifiable that Bitcoin dealers and proprietors will need to require any conceivable security measures to secure their property. To do so, they utilize keys and wallets. Bitcoin possession basically bubbles down to two numbers, an open key, and a private key. A rough relationship could be a username (open key) and a secret word (private key). A hash of the open key called an address is the one shown on the blockchain. Utilizing the hash gives an additional layer of security.

To get bitcoin, it’s sufficient for the sender to know your address. The open key is determined from the private key, which you wish to send bitcoin to another address. The framework makes it simple to get cash but requires confirmation of character to send it.

To get to bitcoin, you utilize a wallet, which may be a set of keys. These can take diverse shapes, from third-party web applications advertising insurance and charge cards to QR codes printed on pieces of paper. The foremost imperative refinement is between “hot” wallets, which are associated with the internet and so helpless to hacking, and “cold” wallets, which are not associated with the web.

Within the Mt. Gox case over, it is believed that most of the BTC stolen were taken from a hot wallet. Still, numerous clients depend on their private keys to cryptocurrency trades, which basically could be a wagered that those trades will have a more grounded defence against the plausibility of burglary than one’s possess a computer.

Thanks for the very easy-to-understand explanation! It’s so popular and I’ve been struggling to understand how it works.

I’m still confused how this bitcoin works but i know that this is becoming popular now.. Some are even considering this as a great form of investments. Thank you for sharing